Sports betting operators considering an application to join the new sports betting market in the US state of Ohio may have cause to think again after the latest legislative developments.

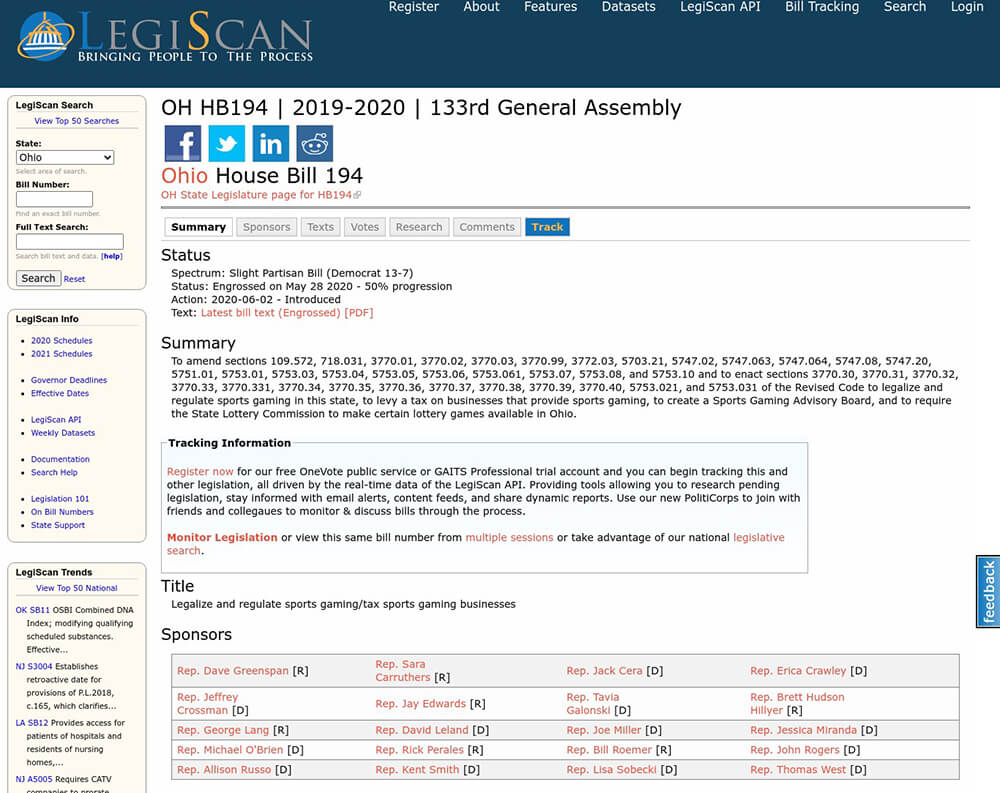

The newest draft of HB194 that proposes to introduce sports betting to Ohio has cut the number of proposed sports betting licenses from three per casino and racino, as proposed in the previous version drafted in September, down to just two, significantly restricting opportunities for those sportsbooks who are attracted to the potential of the Ohio market.

To some extent, the change is not a surprise. One of the bill’s sponsors, Senator John Eklund, has gone on record, saying that many of the details in the last draft were placeholders. The original bill gained the approval of the House in May but will need to secure fresh approval to go forward.

Back in September, Eklund said that the draft produced at the time had been as the result of a conversation with a range of members, but that the final version wouldn’t be known until all possible stakeholders had been able to make their input:

“They’re all subject to a conversation with other senators, state reps, and other interested parties. I commit to all of them that their input will be sought and considered, and I think that’s important for all parties that are interested in this to know.”

The Ohio state legislature is running out of time to get sports betting passed this year. It has until the end of December to pass HB194 during its current lame-duck session.

That urgency helps to explain the significant changes as the bill comes under ever more scrutiny. The reduction in the number of licenses, which will effectively cap the Ohio sports betting market at 22 operators rather than 22, was the headline-grabbing change, but it wasn’t the only significant detail about the original draft bill to emerge in the last few days.

According to the new version, the Casino Control Commission will be the regulator of the new sports betting sector, despite the fact that some stakeholders were pushing for the Lottery Commission to be given this oversight. In addition, neither casinos nor racinos will be required to give out all of their

available sports betting licenses, with the language softening on that issue in the new draft.

In terms of license fees, companies providing management services will still be required to pay $10,000 when applying for a license, but the renewal fees have now increased, from $1,000 every year to $10,000 every three years. Operators will also be prohibited from subtracting the federal excise tax of 0.25% on all bets from their gross revenue receipts, although operators will be hopeful of having that tax repealed by federal courts.

On the plus side, the proposed tax rate of 8% has been maintained in the new draft bill, despite speculation that this might rise. And employees who have previously worked for offshore sports betting companies, effectively providing illegal services, will be able to work in the legal Ohio sports betting market, providing that they didn’t accept any illegal bets in the US from April 16, 2015.

0

0 7966 views

7966 views 0

0 6619 views

6619 views 0

0 7690 views

7690 views 0

0 6560 views

6560 views 0

0 7466 views

7466 views 0

0 9804 views

9804 views 0

0 9492 views

9492 viewsInteractive map with projections and information about the legalization for every state.

Legalization Tracker 0

0 7073 views

7073 viewsDiscover which sportsbooks are the most trustworthy, offer the best bonuses, and find the active promo codes.

About Betworthy

Our team consists of industry experts, professional gamblers, and passionate sports journalist. We have a rigorous review process and editorial standards and we do our best to keep treating our readers fairly and providing unbiased free and professional information.

120 k Monthly Visitors

200 + Helpful Articles

If you or a loved one is struggling with a gambling addiction, this page will provide you with all you need to know to get help.

Learn more →

Learn how to make educated bets and go from placing simple singles to advanced strategies and how to spot arbitrage opportunities.

Learn more →